The “sharkfin” payoff its distinctive by its shape and is defined as a product which pays a positive performance linked return as long as the barrier is not breached. If the barrier is breached the payoff is a fixed payment which is usually much lower than the maximum underlying linked return. Plotting this payoff on a chart gives the recognisable sharkfin shape and is illustrated later in this article.

These products can be capital protected or at risk and can be bullish, bearish or dual directional in market view. Therefore the term sharkfin can be applied to a wide range of products. The barrier is typically set at a level in excess of 100% and will apply when the underlying rise rather than most barriers in structured products which cause capital to be at risk when the market falls.

Markets using the sharkfin payoff

The top three countries for issuance of sharkfin structures are China, South Korea and Brazil. Some 718 products are currently live in China, and 98% of the sharkfin products are capital protected and pay at least 100% of capital at maturity. Globally the picture is similar according to data from www.structuredretailproducts.com..

A recent example from China is the HSBC 2Y CNY Note S83 linked to the Hang Seng China Enterprises Index. This product pays a rebate of 2.5% if the barrier is breached and otherwise pays 100% of the underlying performance. This product is two years long and the barrier is measured annually so it will be breached at the mid-point or final date of the product term if the underlying is greater than 120% of its initial value. If the barrier is not breached the index linked payment is based on the average return of the index over 8 quarterly measurements over the product term. This is a variation on the traditional sharkfin style payoff which has a barrier that can be breached annually rather than just at maturity. It also uses averaging in the return calculation.

Variations in the US

In the US the most common structure with a sharkfin feature is the absolute return (dual directional). This is another twist on the basic sharkfin shape but uses the same principle of market linked returns to a point and a fixed return outside the range. An example of this is the Barrier Absolute Return Market-Linked CD - S&P 500 (61765Q5W5) issued by Morgan Stanley. This product pays 100% growth or decline in the underlying as long as it stays within the range 80% to 120% of its initial level. If the barrier is breached the investor will receive a return of 2% plus their initial investment. In this case the barrier is measured on a daily basis.

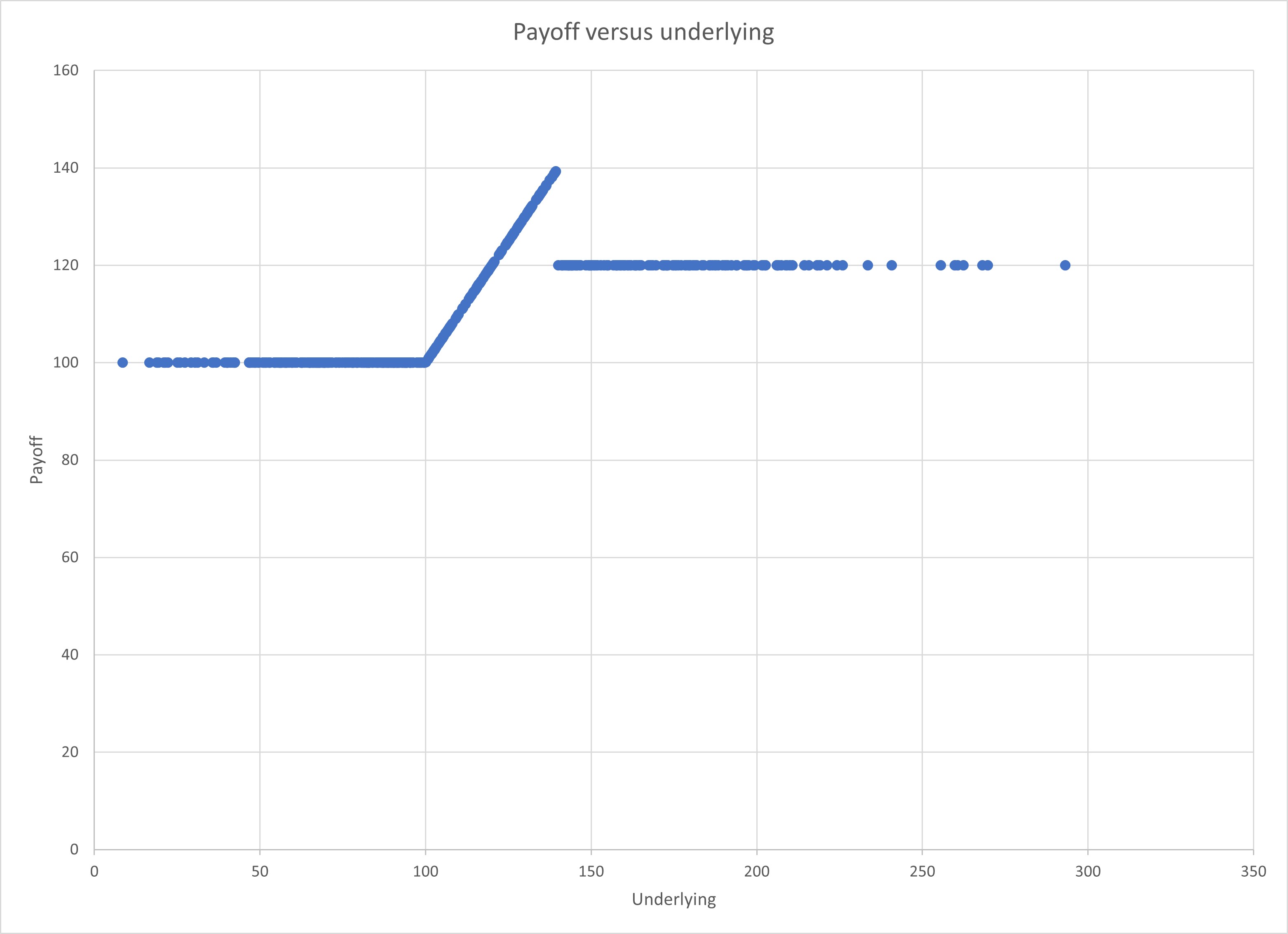

A simple example of a sharkfin product has been recently issued in the UK by Goldman Sachs with Mariana Capital Markets as plan manager. The FTSE CSDI Participation Digital Deposit Plan October 2021 pays 100% of capital at maturity plus a return equal to the growth of the underlying unless the final day barrier of 140% is breached. If indeed this barrier is breached so that the final level of the index is more than 40% higher than its initial level at the end of the product term then the product will pay a fixed return of 20%. The product payoff is illustrated in figure 1 below.

UK market

Capital protected growth products tend to be long volatility because higher volatility will mean more potential for underlying growth over the product term. This means they get harder to structure when volatility is high. The sharkfin barrier element changes the products relationship to underlying volatility in a similar way to a cap would do but to a greater effect. If volatility increases, the chances of hitting the barrier will also increase. In addition it is clear that the sharkfin will reduce the products return prospects and price significantly.

Comparison with other product types

The table below shows the typical participation that could be achieved for three products based on the UK example. The first is the sharkfin, second is a capped product with the cap at the barrier level of 140% and the third is a simple participation growth product. All three products have a maturity of 7 years and are 100% capital protected at maturity. These results illustrate that by using the sharkfin feature on a capital protected product it is possible to offer significantly greater participation up to the maximum return. The sharkfin product would outperform the other two examples if the underlying finishes below 140%. However the sharkfin would underperform in a very strong market, for example If the index finishes at 150% of its initial level the sharkfin would pay a return of 20% in addition to capital whereas the capped and uncapped would pay higher returns of 32.5% and 30% respectively.

| Product type | Participation | Maximum return |

| Sharkfin | 100% | 40% |

| Capped | 65% | 40% |

| Uncapped | 60% | N/A |

SharkFin products are also common in South Korea and are usually similar to the UK product. The DB Safe ELB 667 linked to the Kospi 200 is a typical product from the region offering a minimum return of 101.21% if the final level of the index is less than 100% or greater than the barrier of 115%. If the index performance is positive but less than the barrier the product pays the minimum return plus 13% of index growth. This product has a maturity of 1.5 years and would perform best if the index finished just below the barrier level.

Sharkfin products are typically capital protected and aimed at investors looking to generate returns from moderate underlying growth. These products are able to offer capital protection and decent participation in the underlying by sacrificing returns in the case of strong markets.

Tags: Stress testingA version of this article has also appeared on www.structuredretailproducts.com

Image courtesy of: David Clode / unsplash.com