Independent structured product analytics for financial advisers

In-depth quantitative methodology and reporting

Comprehensive tools for adviser selection and workflow

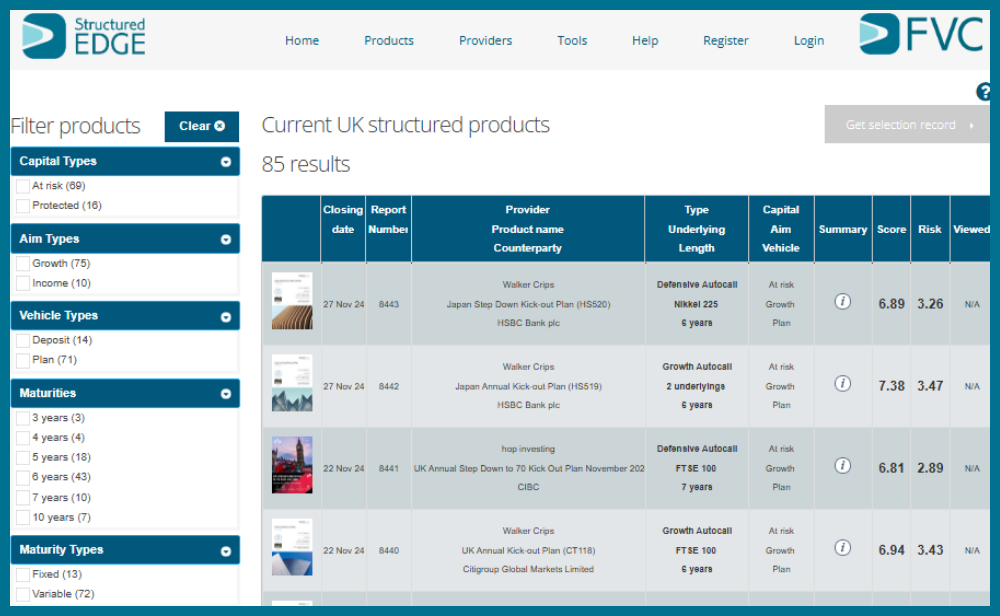

Structured Edge is our structured products analytics platform that offers independent, authoritative analysis of the whole UK retail structured product market. It is for the use of financial advisers (IFAs) and has long been recognised as the industry standard.

Since its inception in 1999 over 8,000 products have been evaluated by us and thousands of UK financial advisers use the service to assist with their structured product research, comparison, selection and compliance processes.

Structured products are important to consider as part of an investment portfolio and provide solutions that control risk and offer defined returns. However, the range of product types means that understanding the market is critical to enabling advisers to do business in a compliant fashion and serving their clients' needs to the highest standards.

The main component of our service is a detailed quantitative report that looks at value for money, credit and market risk, possible returns, and the likelihood of various outcomes for each investment. Standardised scores for values and return as well as a risk measure give valuable simple metrics which are standard in other asset classes such as funds.

All products are analysed using the same objective basis and methodologies.

In 2018, we expanded our offering to include an Offshore market service, bringing the same benefits that have long supported the UK market.

We are developing significant improvements to this service with an intended launch early in 2025. This will give financial adviser firms and networks a more comprehensive solution to satisfy their compliance obligations. This includes addressing the new requirements of Consumer Duty, finding the best products and most suitable re-investment opportunities, and managing product lifecycle and client portfolios all in one whole market platform. These enhancements will allow them to deal with this attractive asset class with confidence supported by our systems and expertise.

Our services

Stress Testing and PRIIPs

Structured EdgeI offers stress testing and PRIIPs compliance services for structured products and funds, helping clients meet regulatory obligations via our comprehensive API solution

Visit pageIndependent Valuations

NextVal is our independent valuation service for pricing OTC derivatives and structured products. A comprehensive and scalable solution with many use cases and fully supported by our team

Visit pageStructured Edge

Structured Edge is the premier structured products analytics service for financial advisers. It analyses thousands of products across both the UK and offshore markets

Portfolio, Lifecycle and Funds

Innovative portfolio and lifecycle management for structured products. Quantitative analysis and expertise for structured product funds and other strategies

Visit page