Leading independent stress testing and PRIIPs analytics service

Customisable product types, methodology and reporting

Real-time and scalable fully supported solutions

Stress testing structured products has been an important part of product issuance since the requirement was introduced by the UK regulator.

It published detailed guidance in 2012 and 2015 for product development and governance processes for structured products. This is to ensure that products represent good value for money and have risk and other characteristics that are suitable for the intended investor base. The wide-ranging Consumer Duty directive for all retail investments makes governance even more critical.

In response to these regulations, FVC first developed a reporting service for its institutional clients, which it brought to market in late 2012. We have continued to develop our service as our clients' experiences and requirements evolved and in 2015 we launched our self-service portal to allow our clients to perform instant analysis of their products and track their issuance channel much more effectively.

The EU PRIIPs regulation came into force in January 2018 (revised in 2022) and requires a Key Information Document (KID) to be generated when an investment is offered into the retail market in the EU and the UK. The requirements for each document have been specified in detail and involve text, information and calculations for risk, scenarios and costs.

The numerical values that need to be shown on the KID involve complex simulations and calculations. Servicing this requirement for an issuance pipeline of a top investment bank requires modelling and data expertise, an understanding of the regulatory technical standards (RTS) and collaboration with clients to ensure a calculation approach consistent with their understanding and intended approach.

FVC has an integrated solution that services both stress testing and PRIIPs, allowing parallel generation of results.

We have wide coverage of underlying assets and product types across equity, fixed income and FX asset classes and are always extending system capabilities. We provide a robust and convenient API solution for clients needing to perform high volumes of calculations.

Over the years, our service has been adopted by many investment banks and distributors. We believe this is due to our extensive modelling capability, wide underlying coverage, the flexibility of our analysis and reporting, and the provision of compliance and workflow tools. These are all fully supported by our dedicated team of analysts. We have also worked with clients and industry bodies to ensure that our system is compatible with assumptions and methodologies such as those specified by the UK Structured Products Association.

Our services

Stress Testing and PRIIPs

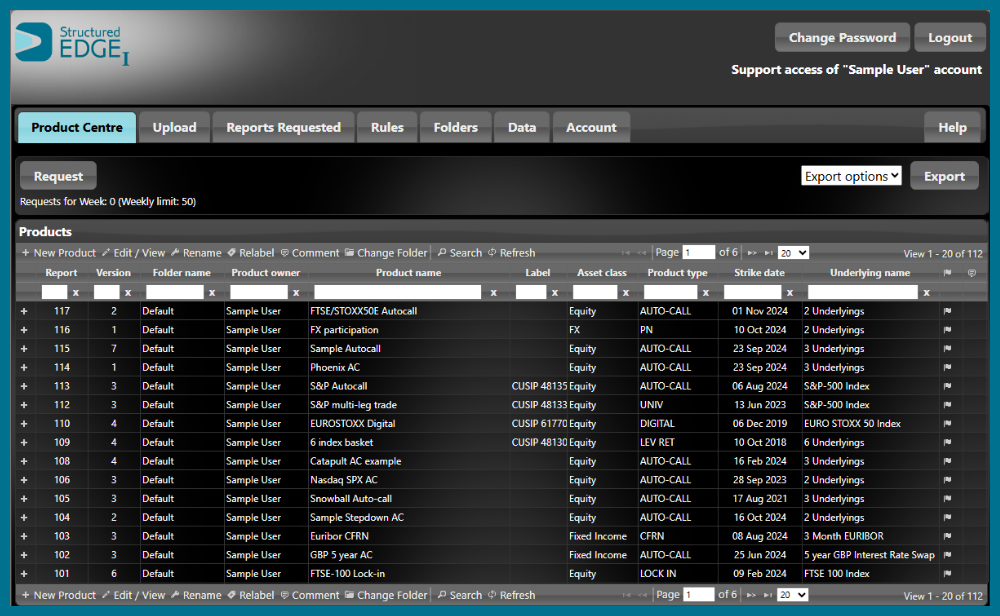

Structured EdgeI offers stress testing and PRIIPs compliance services for structured products and funds, helping clients meet regulatory obligations via our comprehensive API solution

Independent Valuations

NextVal is our independent valuation service for pricing OTC derivatives and structured products. A comprehensive and scalable solution with many use cases and fully supported by our team

Visit pageStructured Edge

Structured Edge is the premier structured products analytics service for financial advisers. It analyses thousands of products across both the UK and offshore markets

Visit pagePortfolio, Lifecycle and Funds

Innovative portfolio and lifecycle management for structured products. Quantitative analysis and expertise for structured product funds and other strategies

Visit page