StructrPro is a US structured products data service that covers live and matured products from the SRP US database using analytics powered by FVC. Using data from StructrPro this article will look at trends in product maturities in the US market.

The following analysis covers products striking since January 2021. Products are grouped into six-month periods and the products within each period can then be group into categories by different criteria. The notional amounts (estimated sales volumes) are provided by data from structuredretailproducts.com.

Popular maturities and product types

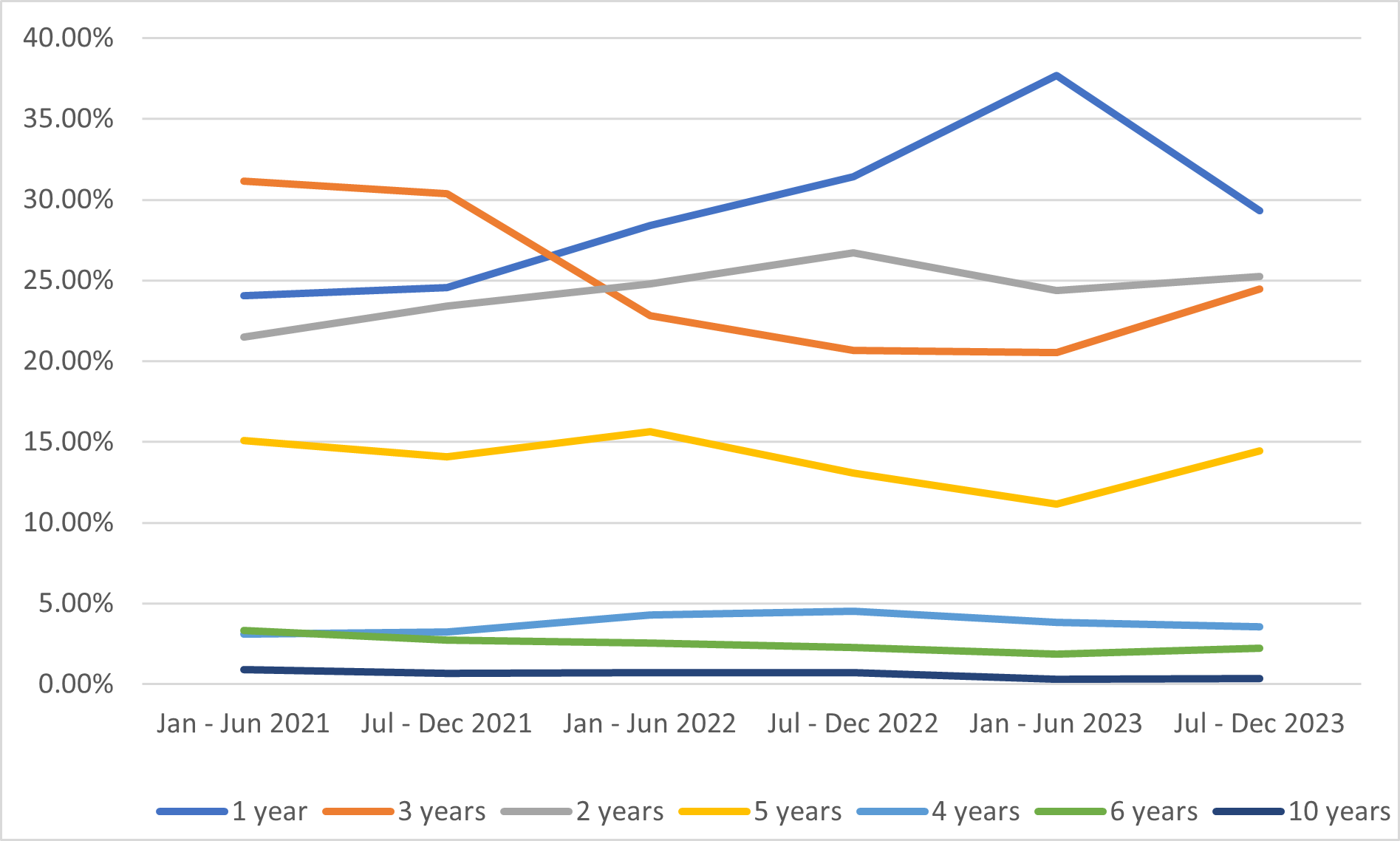

During the period there were structured products issued with maturities ranging from 3 months to 15 years. The most popular maturities for structured products in the US are 1, 2 and 3 years as shown in Figure 1. Products falling into these categories make up 78% of all products striking since January 2021.

from Jan 2021 – December 2023.

Analysis of product returns

Drilling down further and incorporating capital protection and investment aim (growth or income) shows that the most popular products by notional are one year at risk growth products which includes digital, leverage return and dual directional. The second most popular category is the three year at risk income category which is made up almost entirely of income autocall products – the most popular product type in the US. As the different maturities seem to favour different product types (at least between the one and three year groups) the change in popularity seen in Figure 1 is likely to be a result of change in interest in the product type rather than the maturity itself.

The products with maturities of 15 years are all income paying products, mostly contingent income with coupons paid if the underlying is greater than the coupon barrier on the required observation dates. A minority (17%) are income autocall products which allow for early maturity if the relevant conditions are met. These long dated products are all linked to a major index, basket of indices or in a single case a commodity - Light Sweet Crude Oil. Indices and commodities are more suited to long dated products than individual stocks or ETFs as they are perceived to be more stable and lower risk over the long term therefore making the products more attractive to investors.

| Maturity (to nearest year) | Jan - Jun 2021 | Jul - Dec 2021 | Jan - Jun 2022 | Jul - Dec 2022 | Jan - Jun 2023 | Jul - Dec 2023 |

| 1 | 11.64% | 10.25% | 1.13% | -10.29% | 1.42% | 11.29% |

| 2 | 9.33% | 9.45% | 9.67% | 3.57% | 0.93% | 2.12% |

| 3 | 8.92% | 10.99% | 8.77% | 5.00% | 10.08% | 6.79% |

| 5 | 9.12% | 11.57% | 8.50% | 5.54% | 6.71% | 8.63% |

| 4 | 9.02% | 8.38% | 6.67% | 5.47% | 8.38% | 7.93% |

| 6 | 10.69% | 12.58% | 8.81% | 7.67% | 7.73% | 8.84% |

| 7 | 6.45% | 6.07% | 4.19% | 4.20% | 3.51% | 2.20% |

| 10 | 7.86% | 9.36% | 20.99% | 13.38% | 14.86% | 10.59% |

| 8 | 6.91% | 7.25% | 4.98% | 2.39% | 5.03% | 6.03% |

| 0 | 0.00% | 8.65% | -24.83% | 6.25% | 9.61% | 11.93% |

| 15 | 6.30% | 9.61% | 0.00% | 9.11% | 6.18% | 0.00% |

| 9 | 0.00% | 6.33% | 0.00% | 0.00% | 0.00% | 0.00% |

The results in Figure 2 show the average return of products maturing in each period by maturity bracket. The highest returns were recorded in January 2022 – June 2022 for products with a 10 year maturity for which the average return was 20.99%. All of the products maturing in this category in this period recorded a gain but the best performing was a 10 year uncapped at-risk growth product paying returns equal to 3.6066 times the growth in the EURO STOXX 50 Index. The index has risen by over 66% during the product life so given the high gearing the product returned 338.2% of initial investment at maturity.

The lowest return was surprisingly observed in the same period but for products with very short maturities of up to 6 months. The average loss for products in this category during the period was 24.83%. Only 30% of products in this category actually recorded losses but they were so large they had a huge impact on the average return. The biggest losers were two stock linked income products, one linked to Chewy Inc and a similar structure linked to Beyond Meat that both returned around 43% of capital invested.

Importance of maturity in structured products

Product maturity plays an important part in structuring products and it is necessary to balance the returns that can be offered against investor sentiment. In general longer maturity products will offer higher returns for growth products whereas the products paying the highest annual income tend to be the shortest dated. The biggest impact on returns is the underlying performance which is ultimately defined by the product maturity and getting market timing right.

Tags: Structured EdgeImage courtesy of: Joel & Jasmin Førestbird / unsplash.com