Issuer callable products make up around 15% of all products in the US structured products market, a total of over 15,000 products according to structuredretailproducts.com.

We can define issuer callable to mean products that give the issuer the right to terminate the product on a certain set of dates throughout the product term. Issuer callables are different to most payoff types in that the product outcome depends on a choice by the issuer rather than purely the performance of the underlying asset. This will automatically increase yield or upside compared with products with otherwise identical features making them attractive to investors whilst providing a level of flexibility to issuers not present in other structures.

Popularity of Issuer callables

Issuer callable is a product feature that can be applied as a variation to many structured product payoffs. The most obvious and widely used case is the Auto-call payoff converted into an Issuer callable. Another common usage of the callable feature is in long dated fixed income products such as steepeners.

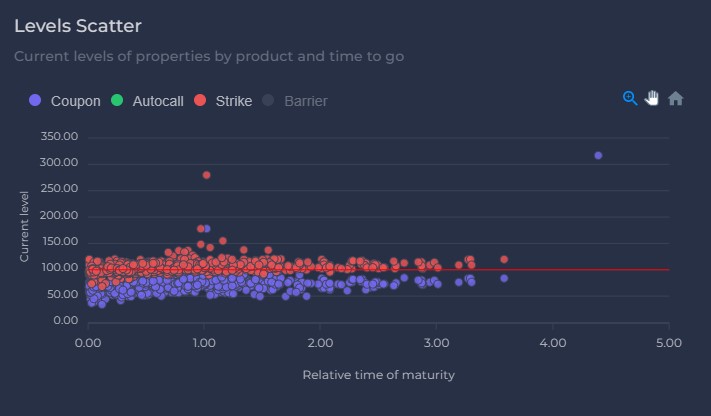

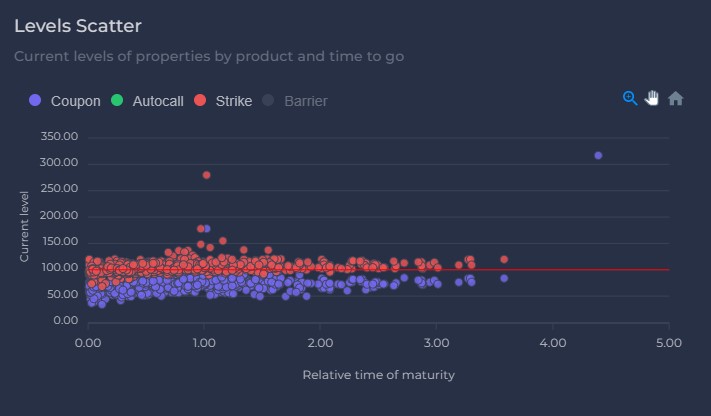

To illustrate Issuer callables are some performance statistics taken from the US structured product analysis service StructrPro.com. StructrPro can be used to analyse live and matured products from the SRP database using analytics powered by FVC. The results here are for equity linked callable products with a strike date within the last year (24 March 2022 – 24 March 2023).

Fig 1: Levels Scatter chart for equity linked callable products striking 24 March 2022 – 24 March 2023 (StructrPro.com)

Figure 1 shows rebased key product levels. This shows that for many products the current level of the respective underlying is below the strike level. The three most popular underlyings for callable products in the US are the S&P 500 Index, Russell 2000 Index and Nasdaq 100 Index. Just under 75% of callable products have exposure to at least one of these indices and many as part of a “worst-of”. All three of these underlyings have fallen over the past twelve months which is in line with the results seen on the scatter chart.

Income solutions

As with autocalls, Issuer callable products usually offer returns when the product is called or by way of a fixed or conditional coupon stream. The levels chart shows that for almost all product with a coupon barrier the current level of the underlying is greater than the required level and therefore coupons are likely to be paid. The capital at-risk barrier is in general the same level or lower than the coupon barrier meaning for the vast majority of products in this category striking over the past year the underlying is currently above the at-risk barrier level.

Fig 2: Product break down and return by underlying for equity linked callable products striking 24 March 2022 – 24 March 2023 (StructrPro.com)

Figure 2 provides a breakdown by underlying for Issuer callable products on StructrPro.com. The chart also shows the return per annum of the product grouped by underlying. Callable products are showing very strong returns ranging from 8.52% pa. to18.7% p.a. for the most popular underlying assets. Due to the callable feature it is not known whether these products will call or continue past the next call dates, it will be up to the issuer to decide whether it makes economic sense to carry on the product and therefore pay the necessary coupons and returns or to terminate the product early.

Pricing complexities

The issuer callability makes the pricing of these products more complicated. For independent “fair value” pricing it is necessary to assume that the issuer will always act rationally to exercise, which would mean doing what would minimise the expected value of what they have to pay out given the product and market performance. On occasions an issuer may be more or less inclined to call than the theoretical answer for reasons of balance sheet or terminating an investment.

To price a callable a technique called "backwards induction" is generally used, rather than simple Monte Carlo. The reason for this is to be able to compare from an issuer’s perspective the difference between calling on the product call dates and allowing the product to continue with a view to making the most rational choice. The FVC model library that powers StructrPro has recently added this subtle product type in order to cover this important sector of the market.

Issuer callable products make up a significant part of the US structured products market. They can offer high returns for investors and often suit issuers as well. Issuer callable products bring some complexity to pre-strike pricing, stress testing and to lifecycle management but given their popularity investors or advisors clearly embrace them and therefore issuers will likely continue to bring them to market.

Tags: LifecycleA version of this article has also appeared on www.structuredretailproducts.com

Image courtesy of: Luke Southern / unsplash.com