Financial commentators love themes, they love labels and they love acronyms. One of most prevalent examples in the investment world in recent years is the fixation with the group of stocks originally known as “FANG” (Facebook-Amazon-Netflix-Google) coined in 2013, expanded to “FAANG” to include Apple in 2017 and then somewhat clumsily renamed to “MAANG” when Facebook became Meta.

All these companies are household name US Technology stocks. While not identical in business models they can be broadly categorised as consumer or network subscription based with strong social media themes. They are still classed as growth stocks and as such they are distinct to the likes of Microsoft, Cisco and Intel which had a similar mantle in the earlier tech boom era of 1990s. This gave rise to the dot-com bubble of the late 1990s which sucked in money to internet based businesses few of whom proved viable, one shining exception being Amazon.

The pull of well-known tech stocks

These five companies are not such universally dominant constituents in the S&P-500 as might be thought from their press interest. While three of the MAANG stocks are in the top five of the index by capitalisation, Meta is at number 22 and Netflix down at 50th. However because of distributor and investor activity they do feature prominently in the US Structured Products market according to data from StructrPro.com, drawn from the database maintained by www.structuredretailproducts.com. Of stock-based products from this universe, Apple is by far the most popular and the five MAANG stocks are all in the top eight by number of products issued. They are only broken up by Tesla (second most popular linked stock overall), Nvidia and Microsoft.

The MAANG companies all had strong growth in the last few years and benefitted from the sudden changes in the world economy during the pandemic as online based businesses thrived. However in the last twelve months much of these gains have been reversed with MAANG stocks all down 50% or more, compared to the S&P-500 as a whole falling by only 20%. The decline of this group has been due to a combination of factors. The higher volatility of the stocks means they will fall faster in a downturn. The market also has concerns about continued growth as their subscriber base becomes more mature and with economies moving into a recession.

Popular structured product underlying choice

A total of nearly 2000 products linked to one of the five MAANG stocks have been analysed on StructrPro. Apple and Amazon are by far the most dominant choices with 52% and 26% coverage respectively. The overwhelmingly most popular choice of product type for MAANG stocks is the Income Autocall which makes up 88% of this product set. This is followed by Leveraged return at 5% and Digitals at 2%.

Although Income Autocalls are also the most popular type for the entire US Structured Product market they only account for 34% of all products on the database. Investors tend to look for yield enhancing products linked to single stocks which take advantage of the pricing due to higher volatility to offer a higher coupon. Stock linked products are also generally more tactical and shorter dated whereas the full database includes a significant volume of “investment” products linked to major indices such as the S&P-500 and Russell 2000.

Generating returns

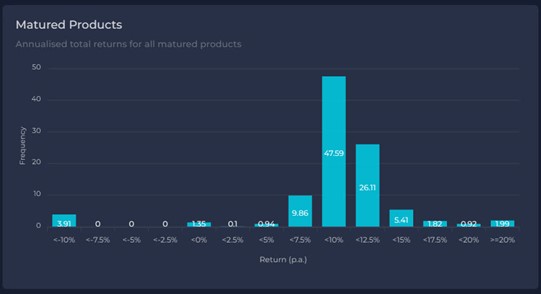

1100 of the MAANG linked products have already matured with an average return of 7%. The vast majority have made a positive return but the average has been dragged down by a small number of products that have breached their barrier and lost a substantial amount.

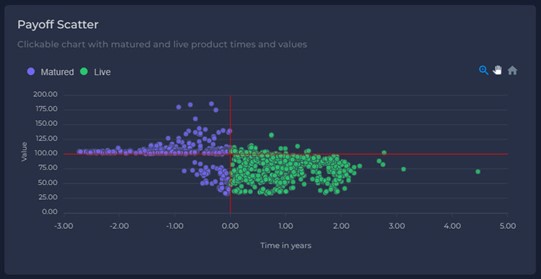

The comparison between live and matured products linked to MAANG stocks shows a very contrasting situation. This is illustrated in the chart below

This may seem surprising but when we understand the price evolution of the five stocks over the last few years and the typical timescale of products it makes sense. The average maturity of these structured products is less than two years and therefore products that have already matured took advantage of the strong underlying performance in 2019 and 2020 sometimes with an early maturity ensuring a positive return. Products issued in the last year have fallen significantly on a secondary market basis because of the stocks decline. This cyclical behaviour is to be expected with more aggressive products such as these but will lead to some difficult conversations between advisers and investors. It is also important to remember that many of the live products are still above their barrier levels giving significant chances for recovery.

The best performing matured product overall is a leveraged return linked to Amazon (SRP ID 16358607, CUSIP 90279Y704). It offered 125% of upside growth to a maximum return of 185%. In the end the stock performed much stronger than this level but the product still posted excellent returns with the benefit of downside protection.

The worst overall matured product was one linked to Meta (SRP ID 32714898, CUSIP 90285B847). It ended in November 2021 over a one-year term that saw the stock decline by 70%. The product did not manage to pay any income and went through the barrier protection that allowed for a 25% decline in the underlying.

Capturing investor imagination

In addition to the sample linked to a single underlying drawn from the MAANG group a further 1250 products on StructrPro are linked to more than one underlying containing at least one of the MAANG stocks. Apple and Amazon are also the most popular choices in this group but the proportion of the remaining three stocks is much higher in this group suggesting that investors don’t really want exposure to the other three (Meta, Google and Netflix) alone. Some other stocks have also found their way into these multi-asset products, the two most common additions being Microsoft and Tesla.

The best performing live product from this group has shown spectacular growth with a current secondary market valuation of 248% and four months of the three year term remaining. This product has 260% upside linked to the worst performing out of Apple and Starbucks (SRP ID 25862562, CUSIP 17328VEK2). These two stocks are in different sectors but both with a strong retail presence and have shown very strong recent growth. Apple is at 222% of its start level and Starbucks somewhat further back at a still positive 157%. Because of the very high leveraged nature of the product its current secondary valuation exceeds that of the Apple stock's performance and with barrier protection of 85% thrown in. There can be few investments that have outperformed Apple over this period.

In conclusion we see that the MAANG stocks have captured the imagination of the Structured product industry. When used by the right investors at a sensible portfolio allocation rate they can offer good yield or growth in many market scenarios. However it should always be remembered that single stock based investing is inherently riskier and this approach does not offer the defensive properties of index linked products. Market timing, understanding of risk and proper portfolio management will always be the key guiding principles to success.

Tags: LifecycleA version of this article has also appeared on www.structuredretailproducts.com

Image courtesy of: Zach Angelo / Pro Church Media / unsplash.com