Mainstream benchmark indices tend to be made up of underlyings within a single asset class such as equities, bonds, FX or commodities. Within equities they can focus on regions, countries or individual sectors. Since most structured products are linked to indices for ease of calculation and to be easily recognised it follows that they will also usually be tied to one asset class.

However most active fund managers with wide mandate would want to allocate dynamically across different asset classes depending on market conditions. “Rotator” strategies are designed to offer an alternative to active investment by allowing for changing in exposure over a number of asset classes by using a rules based approach. This approach makes it viable for an index construction.

A Rotator strategy is one that uses market indicators to determine how the exposure should be split across its component instruments or sub-strategies. The proportion invested in each component will then change (“rotate”) depending on how the indicators move over time.

Sector rotation strategies have a methodology that enables them to adjust their exposure to different sectors dependent on the chosen indicator. They aim to use information about the current phase of the outlook of the chosen sectors and invest accordingly to capture growth in each stage of the economic cycle. One example is the UniCredit European Sector Rotation Strategy which uses the Ifo business climate index as an indicator and has built rules around that. This index is widely used in Germany as a leading indicator of business cycles. The strategy then invests in sector specific ETFs with the allocation determined by the index. Using ETFs ensures liquidity and low costs.

Sector rotation could be considered a “first-generation” rotation concept as it uses information about underlyings classified by sector.

A further development on the rotation concept is to rotate across factors rather than sectors, we can think of this as “second-generation”. Factor investing has gained hugely in popularity in the last ten years using well known investment themes such as Momentum and Value.

A leading example is the S&P Economic Cycle Factor Rotator Index which rotates over factor indices to target those in the optimal stage of an economic cycle or under certain macroeconomic conditions which have proven successful historically. The strategy has four sub indices each representing one of the factors Momentum, Value, Buyback and Low Volatility High Dividend. The index uses the Chicago Federal National Activity Index as the indicator to determine switching between factors.

There are a few live structured products linked to sector rotator strategies but the most popular rotator index is the S&P Economic Cycle Factor Rotator Index. According to data from www.structuredretailproducts.com, there are 500 structured products linked to this index globally. The majority of them are issued in the US market.

Products linked to a complex underlying are often simple in payoff profile and employ capital protection or a tracker type payoff. These product types give exposure to the underlying without adding unnecessary complexity. In the case of protected products they give investors the assurance of capital protection at maturity whilst linking to an innovative index strategy.

Data from the US structured product service Structrpro.com illustrates the performance of products linked to the S&P Economic Cycle Factor Rotator Index. It can be used to analyze both live and matured products from the SRP database using analytics powered by FVC. Figure 1 shows a summary of the data available for the S&P Economic Cycle Factor Rotator Index linked products alongside the whole Structpro.com universe. The performance summary table gives a breakdown of product outcomes separated into live and matured products.

| S&P Economic Cycle Factor Rotator Index | Structrpro.com Universe | |||

| Live | Matured | Live | Matured | |

| Percentage of products showing gain | 0.022 | 0.843 | 0.257 | 0.933 |

| Percentage of products showing loss | 0.978 | 0.157 | 0.743 | 0.067 |

| Average annualised return | -0.0271 | 0.0313 | -0.0428 | 0.0939 |

Figure 1: Performance summary for S&P Economic Cycle Factor Rotator Index and the whole Structrpro.com universe.

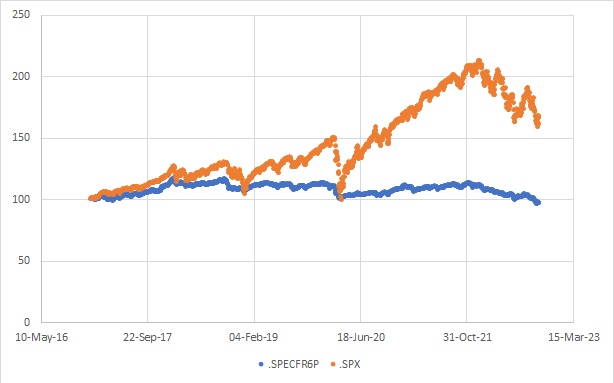

Fig 2: Performance of S&P 500 index and for S&P Economic Cycle Factor Rotator Index since January 2017

Interest rates rising means that capital protected products are more attractive. Uncertainty in markets is also another reason to choose lower risk products. Rotator indices are aiming to take advantage of cycles in markets and benefit from investment timing. These are long term strategies that aim to outperform the regional benchmark. During a period of stability or a bull market these may seem less appealing to investors who can make good returns investing directly in equities or tracker funds. However, when the economic outlook is more unpredictable investors may be more interested in strategies that are tactical and responsive in design.

The products on Structrpro.com linked to this strategy are either protected growth or autocall products. The majority have full capital protection, with a few being partially protected. The performance summary for the for S&P Economic Cycle Factor Rotator Index shows that the matured products have overall showed a gain and an average return of 3.13% per annum. The live product have many more currently showing a loss and a lower expected return, a loss of 2.71% p.a.. These products are mostly capital protected so although the in-life valuation is under par they will in general pay at least the principal amount at maturity, the exception being the partially protected few. Maturity performance does therefore lag the whole database, but this is mostly due to the level of risk taken on.

Rising interest rates mean capital protected products can start to offer more attractive terms as the cost of protection decreases. Underlyings such as S&P Economic Cycle Factor Rotator Index are also favourable for capital protected products as they have volatility control built into the strategy which keeps volatility low (historically under 7%) so that attractive participation rates can be offered.

As investors look to stay well positioned in volatile and uncertain markets with the focus on changing global patterns we can expect Rotator strategies to increase in popularity in the coming years.

Tags: InvestmentA version of this article has also appeared on www.structuredretailproducts.com

Image courtesy of: Marek Piwnicki / unsplash.com