Structured products provide risk-controlled investor solutions offering a blend of yield, returns and protection. The product payoff profile can range from having capital protection or being very low risk with defensive features through to leveraged or worst-of or multi-asset with the potential for significantly higher risk.

Much attention is rightly paid to the product payoff but ultimately the performance of a structured product is as much driven by its underlying asset. A product payoff may have a lot of protection built in or be aimed at those with a market neutral or bearish outlook (for example range accruals or bear products respectively). However for capital at risk products in particular solid performance is required from the underlying to avoid capital losses.

Analysis of Hang Seng China Enterprises Index and Boeing

Many investors choose structured products linked to well-known benchmark indices such as the S&P-500, Eurostoxx-50 or Nikkei-225. These indices can perform poorly over certain periods which will negatively affect product returns. In this case the investor would not necessarily be unhappy given that they might otherwise have invested directly into such indices and suffer greater losses.

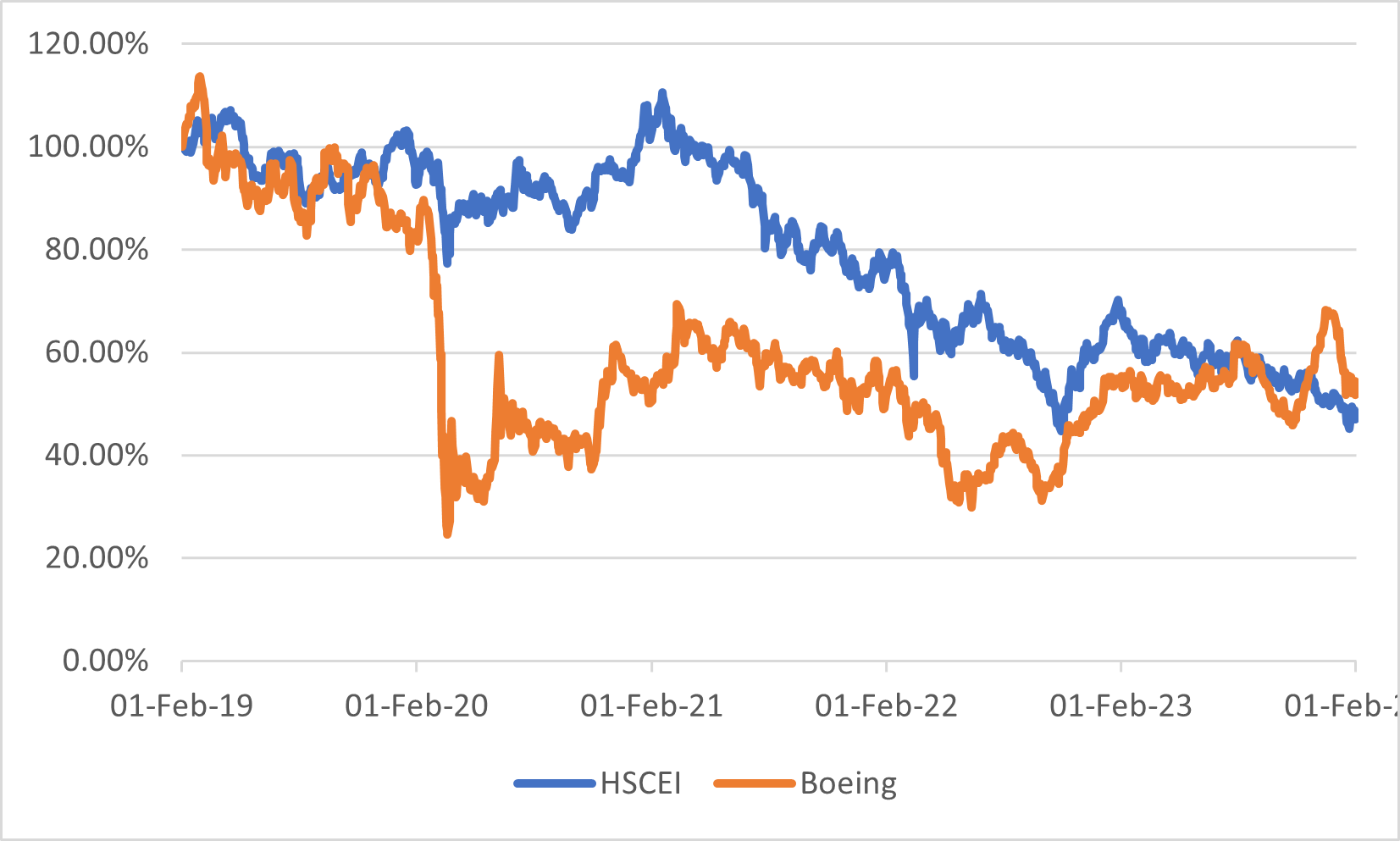

Less obvious choices of underlying assets for structured products pose different questions and we shall analyse two popular underlyings seen in the market that have struggled in recent times. These are the Hang Seng China Enterprises Index and Boeing stock.

The Hang Seng China Enterprises Index (HSCEI) is a market capitalisation-weighted stock index tracking the performance of the largest “H-shares” in Hong Kong. H-shares are Renminbi-denominated shares of Chinese companies listed on the Hong Kong Stock Exchange. These companies and shares give exposure to the Chinese economy but in a liquid and readily tradeable manner.

Boeing is an American company that designs, manufactures, and sells aircraft rotorcraft, rockets, satellites, telecommunications equipment, and missiles. It is the largest aircraft company worldwide by market capitalisation.

Both the HSCEI Index level and Boeing share price have experienced troubles in recent years. The HSCEI has fallen fairly steadily over the last five years and lost over half its value in that time due to various economic and political issues. Boeing was hit very badly in March 2020 at the start of the

COVID pandemic because of interruptions in passenger travel and freight carrying. It fell significantly in that year, and then again in 2021-22 as further economic uncertainty contributed to likely weaker future demand.

| Period | HSCEI | |

| 1 year | Performance | -0.3091 |

| Volatility | 0.2603 | |

| 5 year | Performance | -0.5279 |

| Volatility | 0.2659 |

Source: FVC/Refinitiv

Source: FVC/Refinitiv

While HSCEI has fallen steadily in the last five years, Boeing stock has been more stable in the last year after its earlier sharp falls. Boeing still has a volatility at over 30% but this is significantly down on its five-year average of over 50%. HSCEI index volatility has been around the 26% level over this time which is much lower but in excess of volatility levels of other indices which can often be below 20%.

Despite this, both underlyings remain popular with structured product investors because they are familiar and the high volatility levels allow attractive yields to be offered on typical capital at risk structured products. With sufficient protection and well-judged timing of entry and exit, these products have a good chance of performing well even during a period of some years that has been mostly challenging. Underlying performance is important since investors have alternatives to both of these choices if they do not deliver the returns expected.

Market impact

The HSCEI index is extremely popular in the South Korean structured products market. The outstanding notional linked to products containing the HSCEI (single or as a worst-of) is some $18bn, which puts it at the third most popular underlying in that country behind only the S&P-500 and EuroStoxx-50 but ahead of Kospi-200 and Nikkei-225. Source: www.structuredretailproducts.com.

Typical products tend to be Autocalls of length two to three years, mostly as part of a worst-of. Since the products are relatively short maturity they can offer good yields but with significant defensive properties, with Autocall levels typically 15% or more below the initial spot level and often declining further. Products struck in the last couple of years will be significantly underwater (as the table above shows the one year performance was down over 30%). This means that many of these products will not call but with barrier levels often 60%-65% of the initial levels some may avoid capital loss.

Many investors will not be getting the returns they anticipated and this will also affect the market in the short to medium term as money is not freed up for re-investment and investors may look elsewhere. If investors are sufficiently aware of the risks and have diversified then they may be happy to repeat a similar product given that the index entry level is now much more attractive.

Boeing is also a popular choice of underlying in many markets. Germany has the most number of outstanding products at some 47000, but with a very small average notional so that it only ranks fourth by sales volume. This is a typical feature of the high issuance German market. The three countries with the highest outstanding volume linked to Boeing are Taiwan (USD 4.1bn), USA (USD 2.6bn) and Switzerland (USD 1.1 bn). Source: www.structuredretailproducts.com.

In Taiwan 12 month products are very popular so many of them will have lost value because there is limited time for the underlying to recover. In the US there are many 7 year Certificate of Deposits linked to Boeing (often as a worst-of with other popular stocks such as Apple and Ford). A proportion of these have failed to Auto-call in the intervening years since launch in 2017 or 2018 because of underperformance by Boeing or others. At least these products are fully capital protected but the yield enchancement offerings also linked to Boeing will have suffered losses in many cases.

Product performance

Data from StructrPro shows that for the US market of the 284 products linked to either HSCEI or Boeing some 31% (89 products) have made a loss. This is much in excess of the US market as a whole where overall only 14% of products returned less than the initial investment. However despite this proportion of losses the collection of HSCEI and Boeing products have had an average return of -5% p.a. which is much better than the underlyings themselves (down an average 12% p.a. point to point).

These two popular stocks highlight the importance of underlying choice but also that structured products can protect against much of the market falls. As always, understanding of underlyings, diversification and time in the market are the best routes to success.

Tags: InvestmentImage courtesy of: wuz / unsplash.com