Leading independent stress testing service

Customisable product types, methodology and reporting

Full compliance tool for structured product issuance

Stress testing structured products has been an important part of product issuance since the requirement was introduced by the UK regulator(then the FSA) in 2012 as part of detailed guidance for product development and governance processes for structured products.

Further guidance was published by the FCA in 2015 with stress testing prior to issuance a core component. This is to ensure that products represent good value for money and have risk and other characteristics that are suitable for the intended investor base.

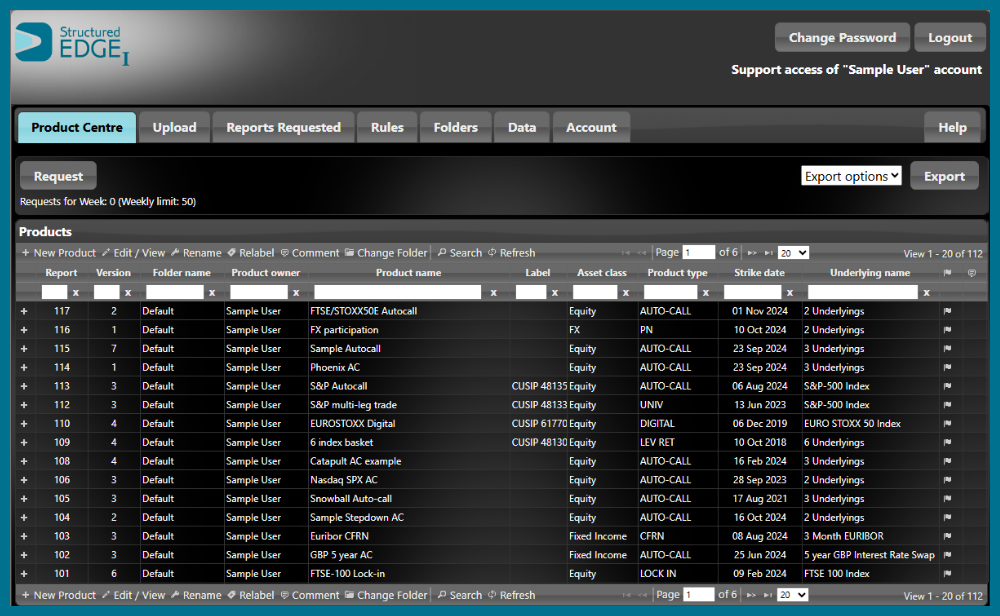

In response to these regulations, FVC first developed a reporting service for its institutional clients which it brought to market in late 2012. We continued to develop our service as our clients' experience and requirements evolved and in 2015 we launched our self-service portal to allow our clients to perform instant analysis of their products and track their issuance channel much more effectively.

We have coverage of equity and fixed income, including many scenario methodologies, product types and underlying assets and are always extending our capabilities. We also provide a robust and convenient API solution for clients needing to perform high volumes of calculations. Our system is also tightly integrated with our valuations and PRIIPs calculations capabilities.

Over the years our service has been adopted by many investment banks and distributors. We believe that this is due to our extensive modelling capability, wide underlying coverage, the flexibility of our analysis and reporting, and the provision of compliance and workflow tools. These are all fully supported by our dedicated team of analysts. We have also worked with clients and industry bodies to ensure that our system is compatible with assumptions and methodologies such as those specified by the UK Structured Products Association.

Our services

Stress Testing

Market leading stress testing service Structured EdgeI for structured product due diligence. Complete solution to help clients satisfy FCA and MiFID II requirements

PRIIPs KIDs

Full calculation and documentation service to satisfy all PRIIPs requirements. Scalable API solution for structured products and funds backed by regulatory expertise

Visit pageValuations

Cloud based independent valuation service Nextval for pricing of OTC derivatives and structured products. Flexible, transparent and fully supported

Visit pageResearch

Structured Edge is the leading research service on structured products for financial advisers. Covers thousands of products for the UK and offshore markets

Visit pageFund Algorithms

Fund algorithms capability developed for quant fund solutions combined with long standing index calculation service specialising in algorithmic indices

Visit pagePrivate Debt

Private debt valuation and advisory service Debtval. An innovative comprehensive framework to assess credit, illiquidity and covenants using our valuation expertise

Visit page