Complete valuation service for a growing asset class

Innovative approach for accurate and meaningful valuations

Leveraging FVC experience in valuation services

Debtval is our private debt valuation service. Private debt loans now require regular valuations under the AIFMD regulation in Europe and the provision of accurate valuations is critical for investors to gain confidence in this rapidly growing market.

Private debt instruments are defined as "Level 3" under accounting definitions. We have developed a robust methodology for valuing private debt drawing on our many years of valuations experience in different asset classes and techniques.

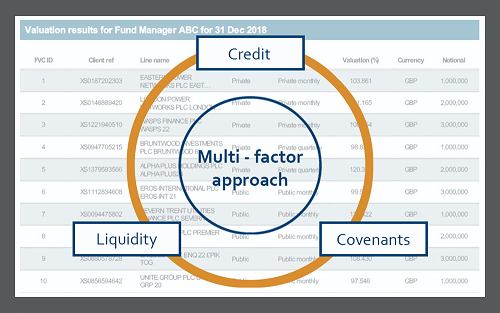

Our methodology has three main components: an assessment of underlying credit, evaluation of the loan's liquidity, and examining the covenant conditions. We also incorporate anchoring and calibration techniques. We have created models which combine these elements to provide a robust, forward-looking valuation process, compliant with the latest guidelines from the IPEV. Each valuation includes data input values and calculation breakdowns to give further insight for our clients.

Our previous valuation experience in a variety of other asset classes means we understand the importance of the assessment of each instrument and creating modelling and data collection approaches. We also provide access to our comprehensive portal reporting system and have a reputation for strong support and providing reconciliation of valuation differences.

In addition to our valuation services, we provide consultancy, assessment and due diligence for investors or funds needing an independent viewpoint on any private debt instrument.

Our services

Stress Testing

Market leading stress testing service Structured EdgeI for structured product due diligence. Complete solution to help clients satisfy FCA and MiFID II requirements

Visit pagePRIIPs KIDs

Full calculation and documentation service to satisfy all PRIIPs requirements. Scalable API solution for structured products and funds backed by regulatory expertise

Visit pageValuations

Cloud based independent valuation service Nextval for pricing of OTC derivatives and structured products. Flexible, transparent and fully supported

Visit pageResearch

Structured Edge is the leading research service on structured products for financial advisers. Covers thousands of products for the UK and offshore markets

Visit pageFund Algorithms

Fund algorithms capability developed for quant fund solutions combined with long standing index calculation service specialising in algorithmic indices

Visit pagePrivate Debt

Private debt valuation and advisory service Debtval. An innovative comprehensive framework to assess credit, illiquidity and covenants using our valuation expertise